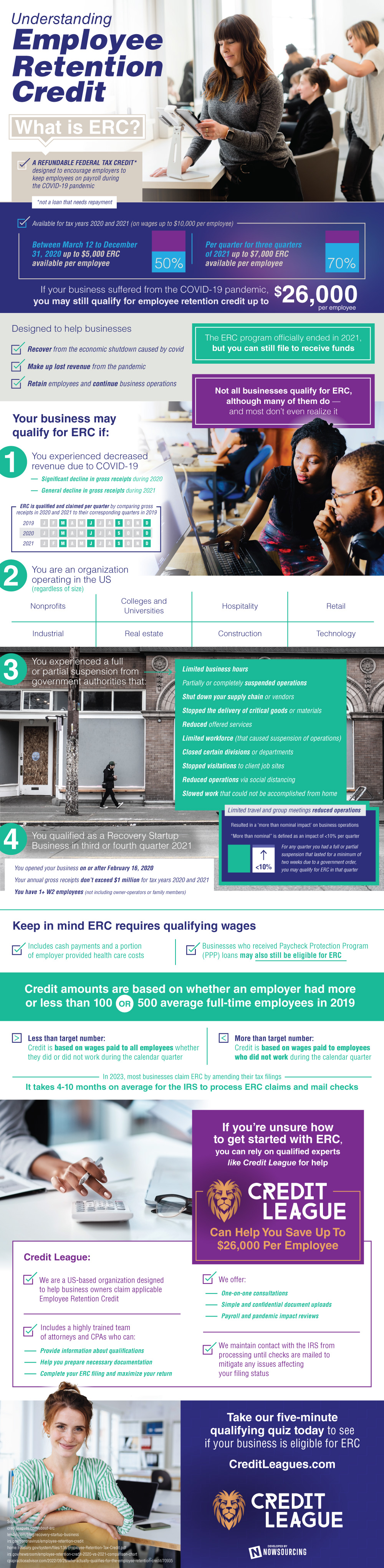

The Employee Retention Credit (ERC) emerged as a robust financial aid strategy during the COVID-19 pandemic. This initiative, available for tax years 2020 and 2021, provided a refundable federal tax credit to businesses. It was not a loan, but a lifeline to help organizations retain their workforce and counter the economic fallout. For businesses experiencing a significant decrease in gross receipts or a governmental intervention leading to operational disruptions, the ERC offered a possible solution. Organizations across multiple sectors, regardless of size, could qualify, including those in the nonprofit, retail, and real estate sectors.

The ERC's unique feature was its inclusivity. Even businesses that received Paycheck Protection Program loans and newly established businesses, termed Recovery Startup Businesses, could potentially qualify for the ERC. Despite the program's official end in 2021, businesses can still file to receive funds.

Understanding the complexities of Employee Retention Credit can be daunting. Expert assistance, such as that provided by Credit League, can prove invaluable. Their experienced team, comprising attorneys and CPAs, is dedicated to helping businesses navigate the intricacies of ERC claims and optimize their potential returns.

Infographic by: creditleagues