The Chip-making company: Nvidia, has now a market worth almost

as much as Amazon.

Nvidia is America’s largest semiconductor company and has

vaulted past the $1 trillion market capitalization mark, a milestone reached by

only a handful of companies including Apple, Amazon, and Microsoft. While many

of these are household names, Nvidia has only freshly gained extensive

attention amidst the AI boom.

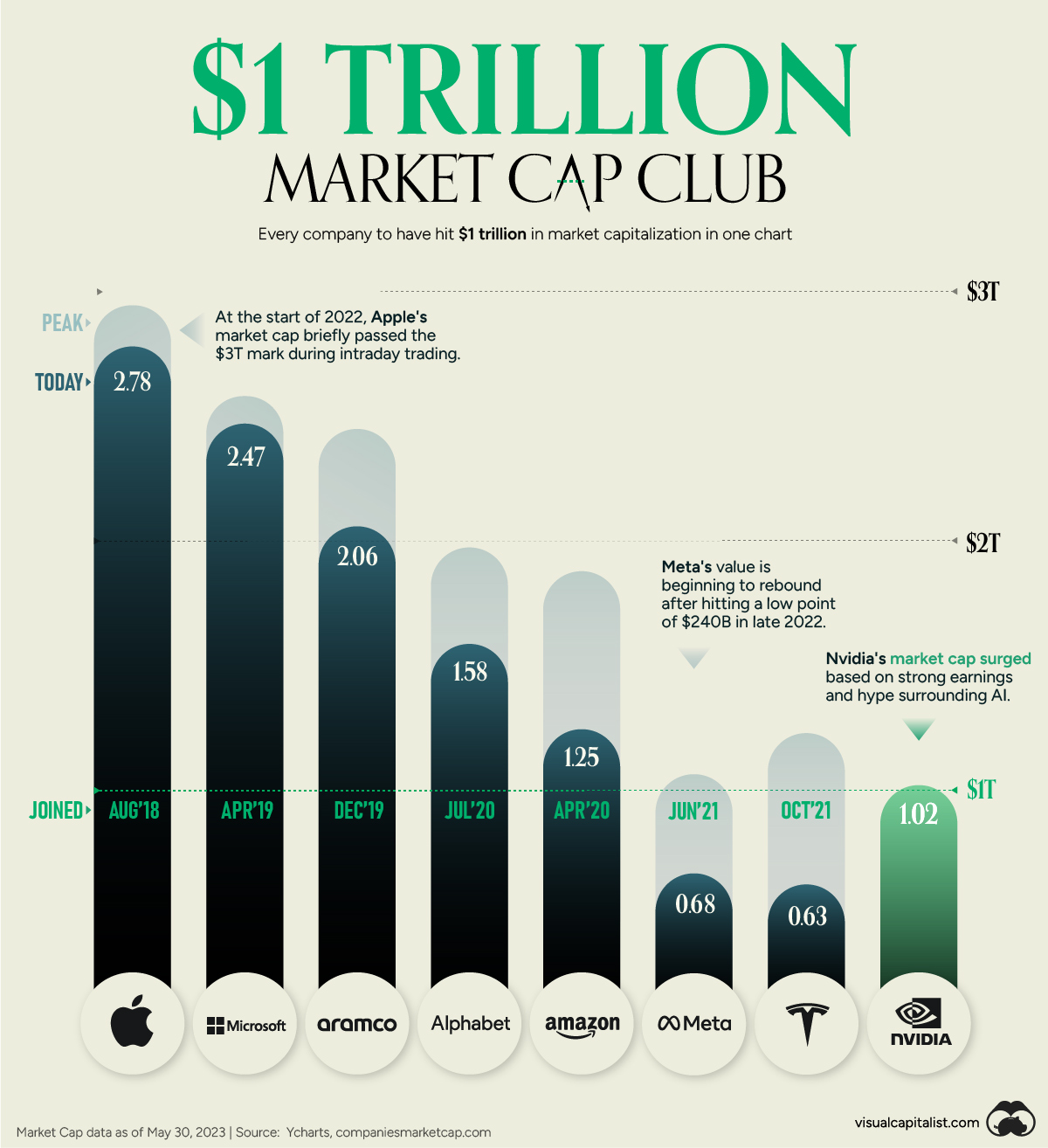

The Infographic used here compares Nvidia to the seven companies that have reached the trillion-dollar club.

Riding the AI Wave

Nvidia’s market cap has more than doubled in 2023 to over $1

trillion.

The company designs semiconductor chips that are made of

silicon slices that contain specific patterns. Just like you flip an electrical

switch by turning on a light at home, these chips are designed with billions of

switches that process complex information simultaneously.

In today’s world, these chips play an essential role to

support many AI functions—from OpenAI’s ChatGPT to image generation. Here is

how Nvidia stands up against companies that have achieved the trillion dollar

milestone:

|

Joined Club |

Market Cap in trillions |

Peak Market Cap in trillions |

|

Apple |

Aug 2018 |

$2.78 |

|

Microsoft |

Apr 2019 |

$2.47 |

|

Aramco |

Dec 2019 |

$2.06 |

|

Alphabet |

Jul 2020 |

$1.58 |

|

Amazon |

Apr 2020 |

$1.25 |

|

Meta |

Jun 2021 |

$0.68 |

|

Tesla |

Oct 2021 |

$0.63 |

|

Nvidia |

May 2023 |

$1.02 |

(Market caps as of May 30th, 2023)

After posting their record sales, the company added $184

billion to its market value in a day only. Only two other companies have

exceeded this number: Amazon ($191 billion), and Apple ($191 billion).

As Nvidia’s market cap reaches new heights, many analysts are

wondering if its explosive growth will continue or if the AI obsession is only

temporary. There are cases to be made on both sides.

Nvidia’s Growth: How long will it last?

This is not the first time Nvidia’s market cap has rocketed

up.

In 2021, during the time of crypto rally, its share price increased

rapidly over 100% as demand for its GPUs increased. These specialist chips help

mine cryptocurrency, and a jump in demand led to a shortage of chips at the

time.

As cryptocurrencies lost their lustre, Nvidia’s share price

sank over 46% the subsequent year.

By comparison, AI advancements could have more

transformative power. Big tech is rushing to partner with Nvidia, potentially

reshaping everything from search to advertising.