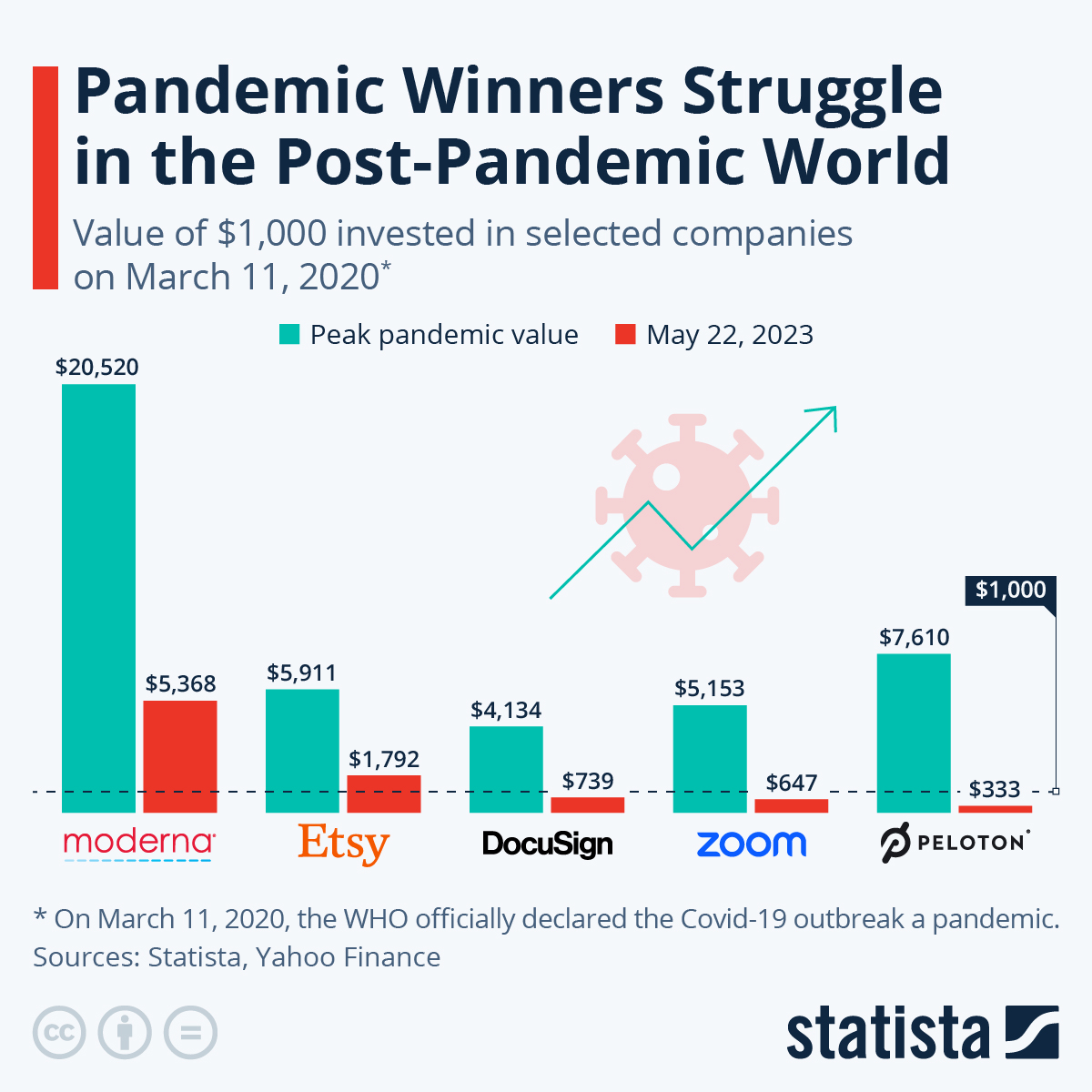

Zoom Video Communications, the company that won great amount of recognition during the early days of the pandemic, reported better-than-expected results for its first fiscal quarter ended April 30, 2023. With total revenue of $1.11 billion and enterprise revenue of $630 million in the first quarter, Zoom raised its full-year guidance as well, expecting around 2 percent revenue growth for the year ending January 31, 2024. That is indeed a far cry from the growth numbers it posted during the pandemic years, as the working-from-home requirements come to an end and rigid competition from Microsoft Teams, Cisco’s Webex and Salesforce’s Slack have brought the former pandemic high-flyer down to earth.

However, Zoom is not the only pandemic winner company and is struggling currently to maintain its momentum in the post-pandemic world. Other companies that ascended under the unusual circumstances created by Covid-19 have also come crashing down over the past year, as normal life slowly returned. Home fitness company Peloton and DIY marketplace Etsy, which benefitted from a hefty volume of mask sales on its platform during the pandemic, are two such examples. Other similar examples are of the vaccine maker Moderna and DocuSign, a company that allows companies to manage agreements electronically.

As the Infographic used here shows, all of the above

discussed companies saw their stock price rush during the Covid-19 crisis, but

all of them have come down at least 70 percent from their peak pandemic

valuation. $1,000 invested in Moderna shares on March 11, 2020, the day the WHO

declared the Covid-19 outbreak a pandemic, would have appreciated to more than

$20,000 by August 2021 and would still be worth more than $5,000 today.

Investors who bought shares of DocuSign, Zoom or Peloton at the beginning of

the pandemic and held on to them until now are suffering from a severe pandemic

hangover, as the value of shares of these companies is now worth considerably

less than it was in March 2020.

Infographic by: Statista