Tesla made quite a surprising announcement in January this

year, that it would be cutting prices on its vehicles by as much as 20%.

Even though price cuts are not new in the automotive world,

they surely are for Tesla. The company, which generally has been unable to keep

up with demand, has seen its order backlog shrink from 476,000 units in July

2022, to 74,000 in December 2022.

This has been attributed to robust production growth of

Tesla, which saw 2022 production increase 41% over 2021 (from 930,422 to

1,313,851 units).

Apparently, the days of “endless” demand of Tesla are over, Tesla

is going on the offensive by reducing its prices. This is a step that puts

pressure on competitors, but has also annoyed existing owners of this brand.

Turning up the Heat

Cutting price of vehicles is Tesla’s attempt to protect its

market share, but they are not exactly the desperation move some media outlets

have claimed them to be.

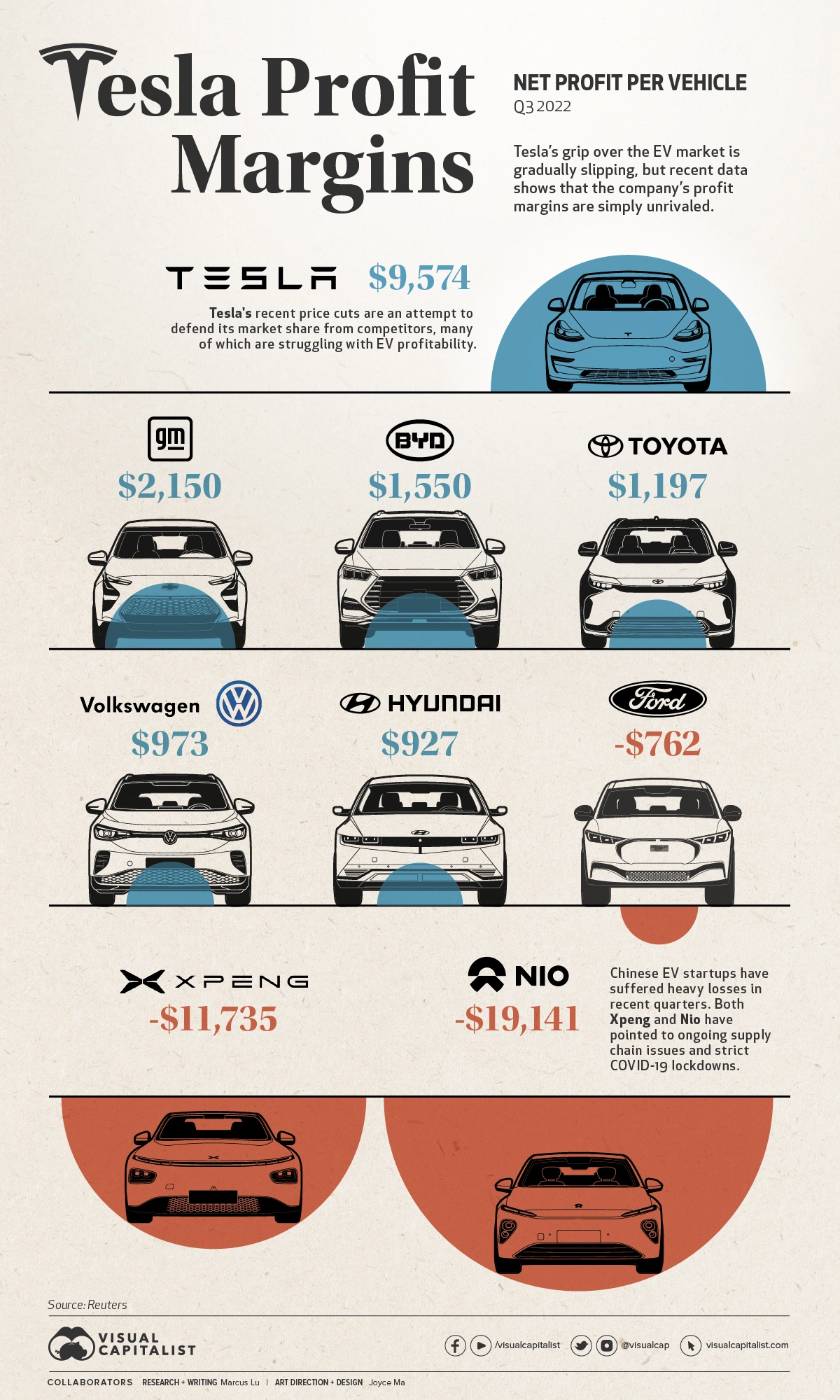

Latest data compiled by Reuters shows that Tesla’s profit margins

are considerably higher than those of its competitors, both in terms of gross

and net profit. The infographic only illustrates the net figures, but gross

profits are also included in the table below.

|

Company |

Gross profit per car |

Net profit per car |

|

Tesla |

$15,653 |

$9,574 |

|

GM |

$3,818 |

$2,150 |

|

BYD |

$5,456 |

$1,550 |

|

Toyota |

$3,925 |

$1,197 |

|

VW |

$6,034 |

$973 |

|

Hyundai |

$5,362 |

$927 |

|

Ford |

$3,115 |

-$762 |

|

Xpeng |

$4,565 |

-$11,735 |

|

Nio |

$8,036 |

-$19,141 |

Price cutting strategy has its shortcomings, but considering

Tesla’s situation, the benefits are worth it based on the above data especially

in a critical market like China.

Tesla has taken the nuclear option to bully the weaker, thin margin players off the table.

– BILL RUSSO, AUTOMOBILITY

In the case of Chinese EV startups Xpeng and Nio, net

profits do not exist, which means it is not likely for them to be able to match

Tesla’s reductions in price. Both firms have reported year-on-year sales drops

in January.

As for Tesla, Chinese media outlets have claimed that the

firm received 30,000 orders within three days of its price cut announcement. It

is to note that this has not been officially confirmed by anyone within the

company.

Tit for Tat

Recently Ford made headlines for announcing its own price

cuts on the Mustang Mach-E electric SUV. This model is a direct competitor to

Tesla’s best-selling Model Y.

Chevrolet and Hyundai have also made some adjustments in their

EV prices in recent months, as listed in the table below.

|

Model |

Old Price |

New Price |

Discount |

|

Tesla Model Y Long Range |

$65,990 |

$53,490 |

18.9% |

|

Chevrolet Bolt EUV 2023 |

$33,500 |

$27,200 |

18.8% |

|

Tesla Model Y Performance |

$69,990 |

$56,990 |

18.6% |

|

Chevrolet Bolt 2023 |

$31,600 |

$26,500 |

16.1% |

|

Tesla Model 3 Performance |

$62,990 |

$53,990 |

14.3% |

|

Hyundai Kona Electric 2022 |

$37,390 |

$34,000 |

9.1% |

|

Ford Mustang Mach-E GT Extended Range |

$69,900 |

$64,000 |

8.4% |

|

Tesla Model 3 Long Range |

$46,990 |

$43,990 |

6.4% |

|

Ford Mustang Mach-E Premium AWD |

$57,675 |

$53,995 |

6.4% |

|

Ford Mustang Mach-E RWD Standard Range |

$46,900 |

$46,000 |

1.9% |

A significant player missing from this table would be Volkswagen.

The company has been gaining ground on Tesla, especially in the European

market.

We have a clear pricing strategy and are focusing on reliability. We trust in the strength of our products and brands.

– OLIVER BLUME, CEO, VW GROUP

This verdict could obstruct Volkswagen’s goal of becoming a

dominant player in EV market, especially if more automakers join Tesla in

cutting prices. For now, Tesla still holds a strong grip on the U.S. market.

Thank You Elon Musk!

Recent buyers of Tesla became furious when the company

announced it would be reducing prices on its cars. In China, buyers even staged

protests at Tesla stores and delivery centers.

Recent buyers not only missed out on a better price, but

their cars have effectively devalued by the amount of the cut. This is a bitter

turn of events, given Musk’s 2019 claims that a Tesla would be a valuable

asset.

I think the most profound thing is that if you buy a Tesla today, I believe you are buying an appreciating asset – not a depreciating asset.

– ELON MUSK, CEO, TESLA

These comments were made in reference to Tesla’s full

self-driving (FSD) capabilities, which Elon claimed would enable owners to turn

their cars into robotaxis.

Infographic by: visualcapitalist