Digital audio streaming has made its place in a big way in

the past ten years. The data provided by Statista’s Digital Music Outlook shows

that the market size of music streaming increased to US$30.33 billion in 2022,

reaching a total of 776.2 million users.

The pandemic years brought an actual growth in the podcast industry,

as people wanted means of entertainment while staying at home which drove up listenership

and advertiser investment. According to Megaphone, a podcast technology company

owned by Spotify, where 2021 was a time of “content explosion”, 2022 has been

one of “diversification”, as the most noteworthy jumps in podcast downloads

came from markets newer to the medium, such as Spain (+298 percent), Italy

(+244 percent), and France (+375 percent), while the highest growth in unique

listeners in terms of age groups was the 13-17 year olds (+49 percent) and the

55-64 year olds (+45 percent).

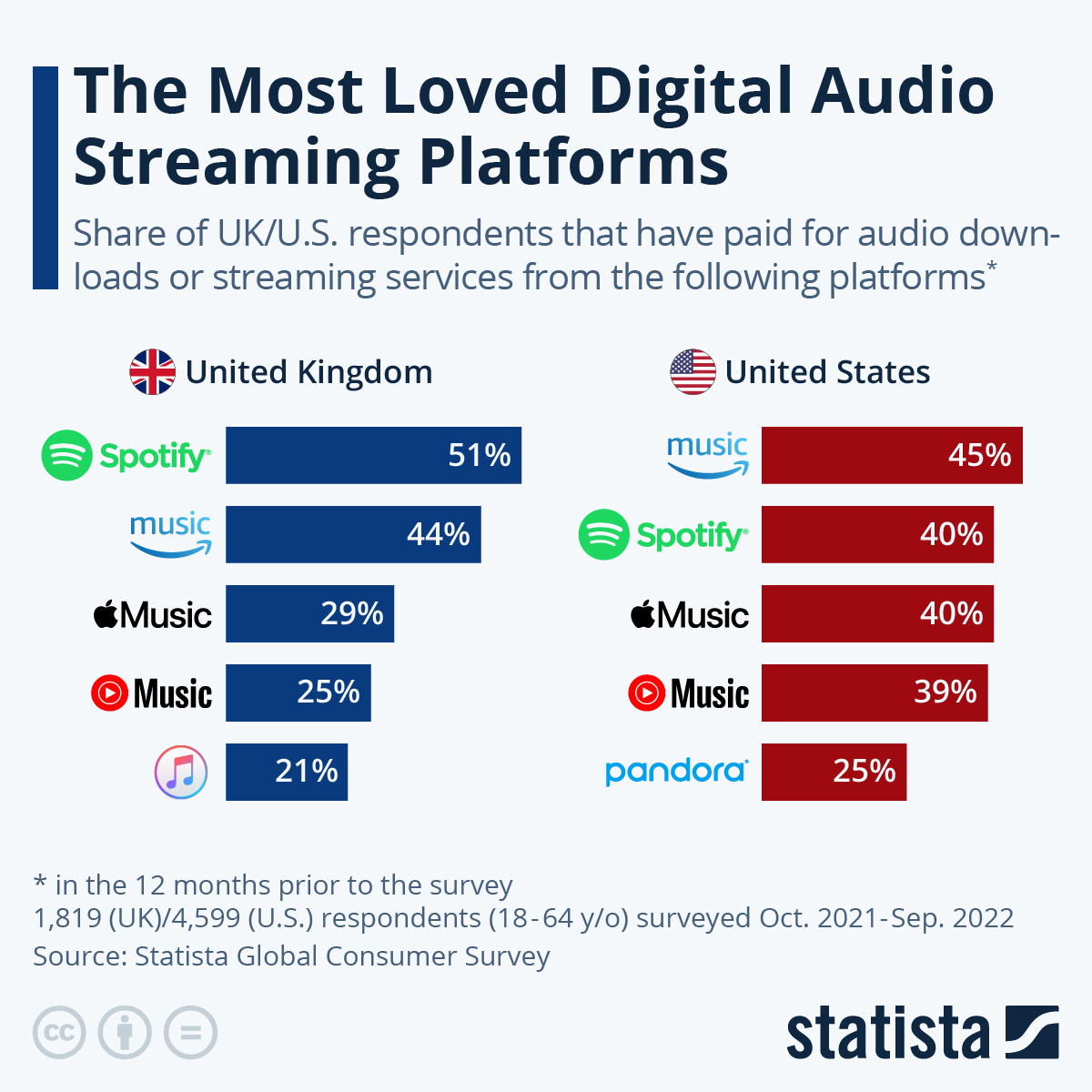

As the infographic shows, a handful of companies are prominent in this era of digital audio content, and both podcasts and music are put in the same group here. According to data collected from Statista’s Global Consumer Survey, Amazon Music is the current king, in the United States, where 45 percent of respondents that had purchased music streaming services in the past 12 months said they had used it. An original startup from Sweden, Spotify, takes the second spot with 40 percent user ship, while in the United Kingdom, this trend is a total opposite. YouTube Music and Apple Music are also equally popular options in both the countries, while the lower ranking platforms start to diverge more; in the UK, SoundCloud (10 percent), Deezer (10 percent) and eMusic (6 percent) rank in 6th-8th place, while in the U.S., these positions are filled by iTunes (24 percent), iHeartRadio (18 percent) and Sirius XM (14 percent).

Analyzing the future of digital audio streaming, Statista’s analysts explain:

“The disruptive impact of music streaming services such as

Spotify or Apple Music has not only won the fight against illegal distribution,

but also broken down all barriers and made access to all kinds of music as easy

as ever. In order to stand out, however, many service providers are now

starting to counteract this trend by focusing on exclusivity, e.g.,

pre-releasing new music or offering unique content such as concerts or

podcasts.”

They further add that while the market can expect to see

some inactivity - especially related to subscription services - as consumers

try to lower their personal expenses due to the current state of the economy,

the industry will likely still see continued growth overall.

Infographic by: statista