A housing bubble can be described as a market condition when

prices rise beyond what most people consider as sustainable or reasonable. One good

way to identify if this condition exists is to look at home prices in terms of

household income. In a balanced housing market, the median home price is about

four times the median household income. When it starts to exceed five times, a

bubble is forming.

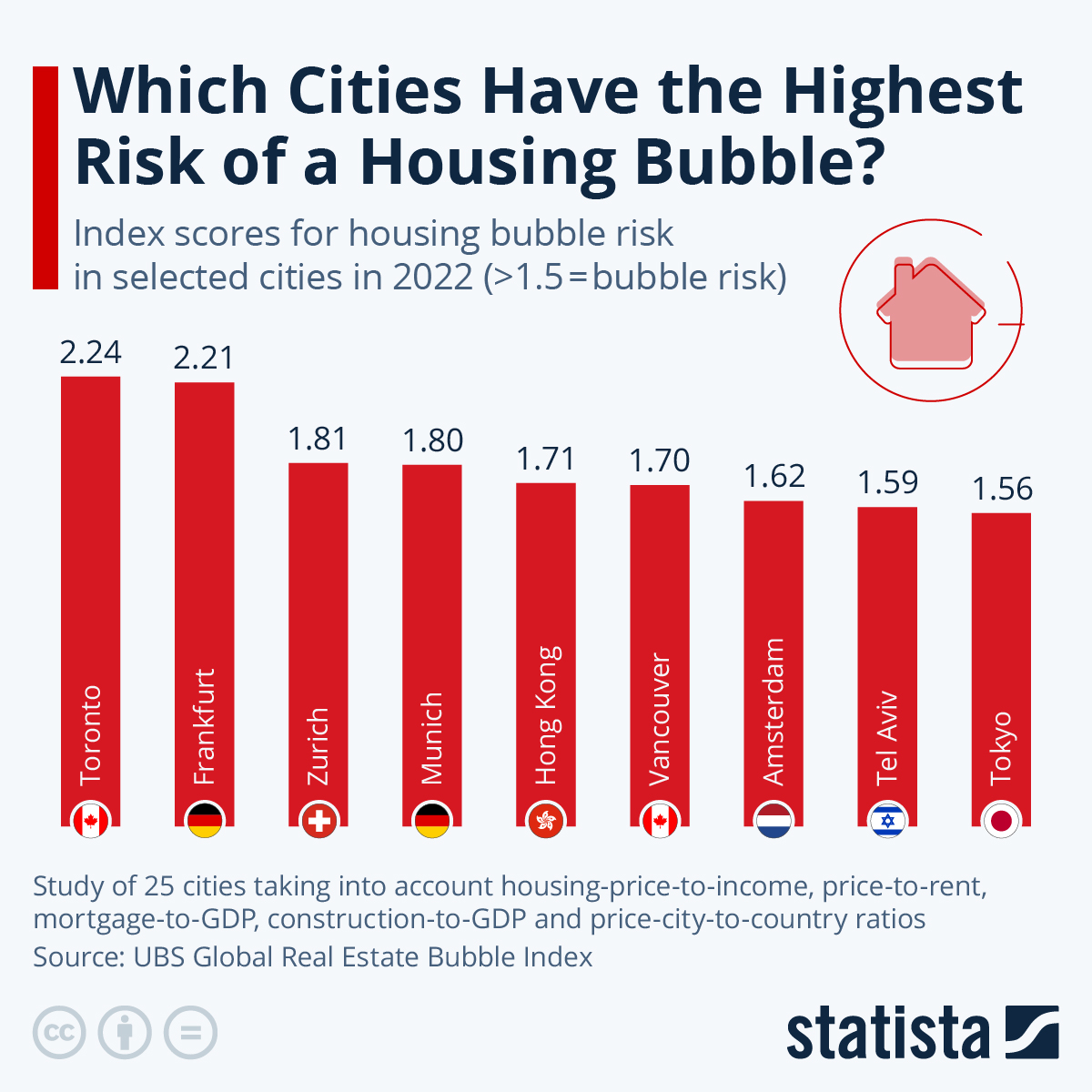

In a recent survey released by investment bank UBS, it was

found out that the Canadian city Toronto had the highest risk of a housing

bubble developing. Other cities at high risk include Frankfurt, Hong Kong,

Munich, Zurich and Vancouver.

In Toronto, the housing prices increased by 17 percent in the last year. According to the report, the city at lowest rank, Warsaw was in fair-valued territory, along with Milan, Sao Paulo and Dubai, where the housing market last crashed in 2018 together with oil prices. The U.S. cities in the ranking stayed out of the bubble risk threshold (1.5), however, all their markets were classified as overvalued. Los Angeles and Miami are the cities that were coming close to the bubble territory at ratings of 1.39 and 1.31, respectively.

UBS determines their risk index by looking at different

factors such as: ratios of housing prices to rent and housing prices to income,

the rise in construction spending to the increase of GDP, the growth in

mortgage payments to the increase of GDP and, finally, the ratio of housing

prices in the city and the surrounding areas. Out of 25 cities that were

included in the survey, (all of which are known for their high real estate

prices), nine turned out to be in the bubble-risk territory. Twelve more were

considered to have an “overvalued housing market”, among them are Paris, Stockholm,

and Sydney as well as London, Geneva, and Madrid.

Infographic by: statista