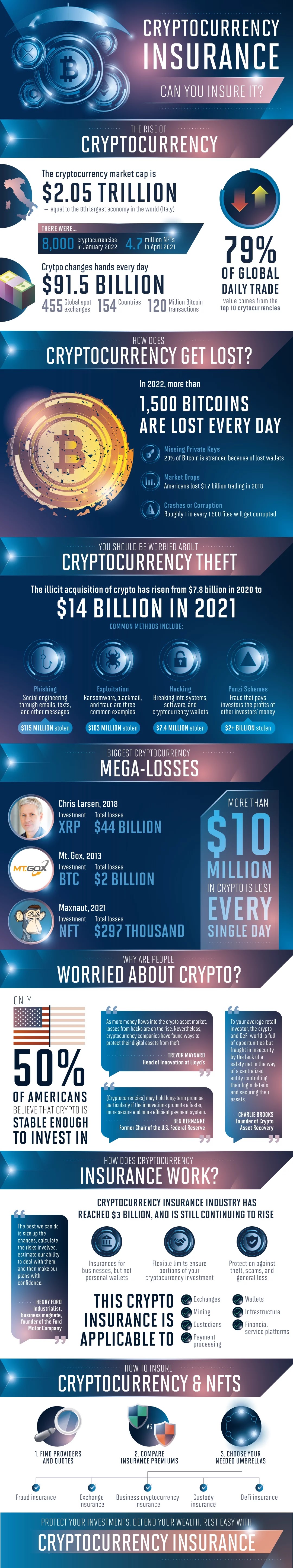

The cryptocurrency market, although it has grown more reliable and has become equal to the 8th largest economy in the world, still comes with inherent risks which make some investors wary of investing. The two biggest risks in the crypto world are loss and theft. Every day, 1,500 Bitcoins are lost due to things like missing private keys, market drops, and corrupted or crashed files. In fact, 20% of all Bitcoin is stranded because of lost wallets, and about 1 in every 1,500 files will be corrupted.

These losses, on top of the rapid growth of crypto theft, especially since the pandemic, have caused some investors to reserve their investing for more traditional outlets.

However, crypto is growing to become something that serious investors can’t ignore, even though 50% of Americans believe it’s still unreliable. This is where crypto insurance comes in.

Crypto insurance, much like any other form of insurance, helps to mitigate the risks involved. Businesses can pick and choose their providers, premiums, and coverage options to best fit their needs, and to provide a safety net around investing in this virtual market.

Infographic by: insuranceproviders