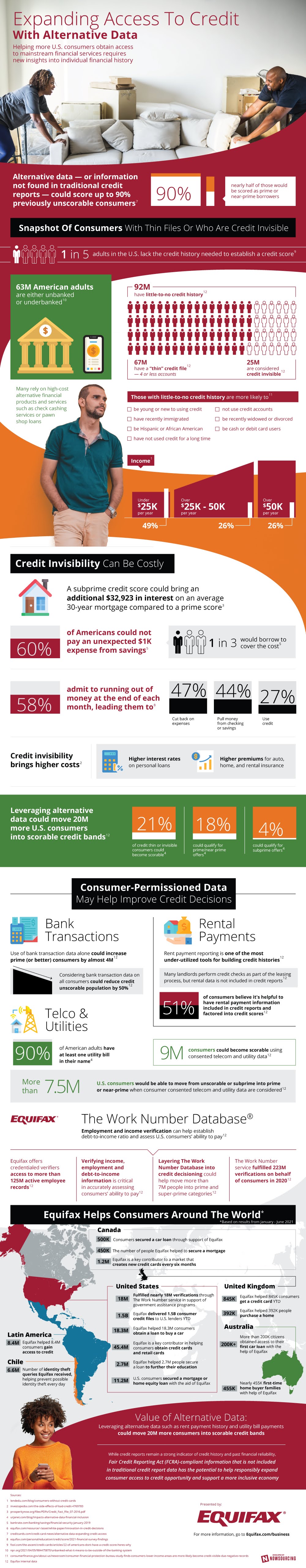

Helping US consumers obtain access to mainstream financial services requires new insights into individual financial history. Current methods of credit reporting leave 1 in 5 American adults in the cold. Credit invisible persons are less able to get personal loans and mortgages than people with sufficient credit history. Insurance premiums are also higher for people who lack a credit score.

Alternative Data Sources in Credit Reporting #Infographic

Helping US consumers obtain access to mainstream financial services requires new insights into individual financial history. Current methods of credit reporting leave 1 in 5 American adults in the cold. Credit invisible persons are less able to get personal loans and mortgages than people with sufficient credit history. Insurance premiums are also higher for people who lack a credit score.