The coronavirus pandemic has caused a financial ripple

across the globe. From economies shattering due to the lockdown, to big

companies going bankrupt, we all have felt that penny-pinch during the

pandemic. People have literally shut down their businesses amidst the lockdown

because they were going bankrupt. A famous example is Airbnb, who said they

have lost in a few months than they made in six years.

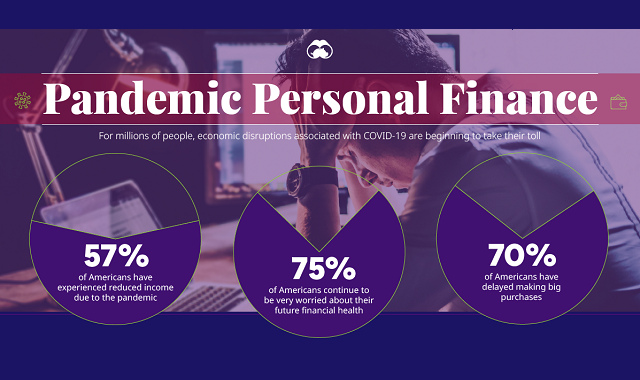

Since the worldwide curfew was imposed seven months ago, 42

percent of US citizens have missed paying their bills while over 39 percent

think that they might have to skip in the future. According to statistics,

about 57 percent of Americans have had some problems with their incomes in the

last seven months whereas, 70 percent have delayed or stopped their spending on

big purchases. This has brought the overall markets down and businesses are

still not doing very well. About 75 percent of people are continuing to be very

worried about their financial status in the future.

Despite the government’s attempt to minimize the costs of

bills and delaying them, it has done minimal in terms of the finances of

Americans. About 27 percent of US citizens have stated that they have missed a

bill on their auto loans, while 26 percent and 25 percent of people said they

have missed their utilities and cable/internet bills respectively. Due to the

uncertainty in the end of pandemic, the spending habits and consumer priorities

are shifting substantially along with the tightened budget.

Take a look at the following infographic for more

information.

Infographic by: visualcapitalist